Though it doesn’t apply to me directly, I’ve been thinking about this tweet below:

By investing on behalf of a public entity, our performance is public, as is the performance of the funds in which we invest. However, our portfolio construction decisions remain hidden behind the veil. Though I like to believe I’m open about how I think about investing, I haven’t publicly shared enough on why we’re building our venture capital portfolio the way we are.

I joined the Texas Municipal Retirement System in 2018, not so long after their first private equity commitment in 2015, and their first venture capital commitment in 2016. There was white space for investing in the private markets broadly, but the venture opportunity appeared near-limitless. There were limits though that I missed from the outside.

Our size (over $30 billion in assets under management) precludes us from making small commitments—our investments have to translate not just into percentage gains, but dollar gains. A $5 million commitment requires the same amount of work as a $50 million commitment, a $100 million commitment, or a $500 million commitment, and when we need to commit over $1 billion annually across private equity and venture capital with a four-person team, we have to brutally focus our time and energy.

Our status as a public entity presents challenges as well. As I mentioned earlier, the performance of our underlying fund commitments is public (inviting further scrutiny to the managers of those funds), but there’s also the historical reputation of public entities being cumbersome limited partners, less nimble and flexible than their endowment, foundation, and private sector peers. I don’t have much sympathy for fund managers afraid of their performance being public, but I do understand that we’re not the easiest type of LP to accept.

These limits constrain where we can play in the venture capital world. Unlike smaller LPs we’re less able to participate in access situations, to compete for a small position in the over-subscribed fund du jour, and when we want to play we have to communicate our public entity-specific needs to those fund managers well in advance. Our scale sometimes makes us attractive to funds managers seeking concentrated capital bases filled by larger LPs—but, those situations are unfortunately not common.

I didn’t internalize those considerations right away. I used to believe we could build a venture fund portfolio like every other LP, despite the constraints of our reality. At first, I looked outward for the playbook to overcoming these challenges—ultimately, I realized such a playbook didn’t exist, and that we’d have to write it ourselves.

Close to three years later, we now have the foundations of a portfolio built like a wheel: the “hub” being a collaborative, strategic relationship where we can more easily scale our capital, and the “spokes” being the interesting, opportunistic situations where we can still make commitments of scale (ideally at $40 million or greater per vintage).

The original venture commitment we made in 2016 was to a hybrid direct/fund investor. We’ve scaled this into the hub of our portfolio, committing $175 million to this relationship ($145 million since 2018), with a focus on that manager’s fund investing activity. Such a relationship helps function as an allocation solution—rather than making $5 million commitments to twenty separate funds, we can make one $100 million commitment to a team that has spent their careers successfully evaluating and investing in funds too small for us to consider on a direct basis.

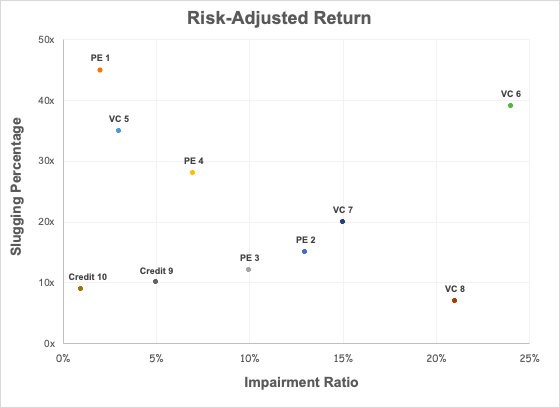

We’ve subsequently added three spokes to that hub over the past year, totaling $150 million in commitments. We approached these commitments agnostic towards stage or sector—they were made through bottom-up evaluations of those fund managers within their categories rather than purely top-down predictions on the performance of specific sectors or stages. These fund managers also have high “slugging percentages”, architecting their portfolios to create a higher likelihood of asymmetric risk-return outcomes. And, we were able to make commitments of scale with these managers.

Despite playing different roles as hubs or spokes in our venture portfolio, these fund managers do share a common trait: they approach investing like art. Though doing so should lead to the high slugging percentages (and returns) that we seek, those metrics are still lagging indicators. We have to evaluate their investment decisions before the outcomes are apparent, requiring us to focus even more on the people themselves. And, if art is the blend of creativity and conviction, then these people should be acting upon the world, creating opportunities and sizing positions independent of whatever the crowds are chasing.

As I mentioned earlier, the playbook for building a venture fund portfolio doesn’t exist. That said, I don’t think it’s possible to make art with another’s playbook, by defining one’s investing through the words of others. Trying too hard to emulate Notre Dame, or Yale, or other LPs more experienced in venture capital would lead us to mediocrity—we would be playing an access-based diminishing returns game as the latecomer to a large, ever-growing crowd. Instead, we’re playing a game for an institution of our scale, while still architecting a portfolio made of investors who make art through their work. And hopefully, while making art ourselves.

Share