2020.05.16

LPs as remix artists & "hype" in fundraising & the investor playing field

“I’d like to say that it’s a hopeful sign that the art market still has hunger for innovation, and that, as much as buyers reward artists for churning out the same thing year-over-year, there’s still room to branch out,” says Kevin Wiesner, a creative director at MSCHF.

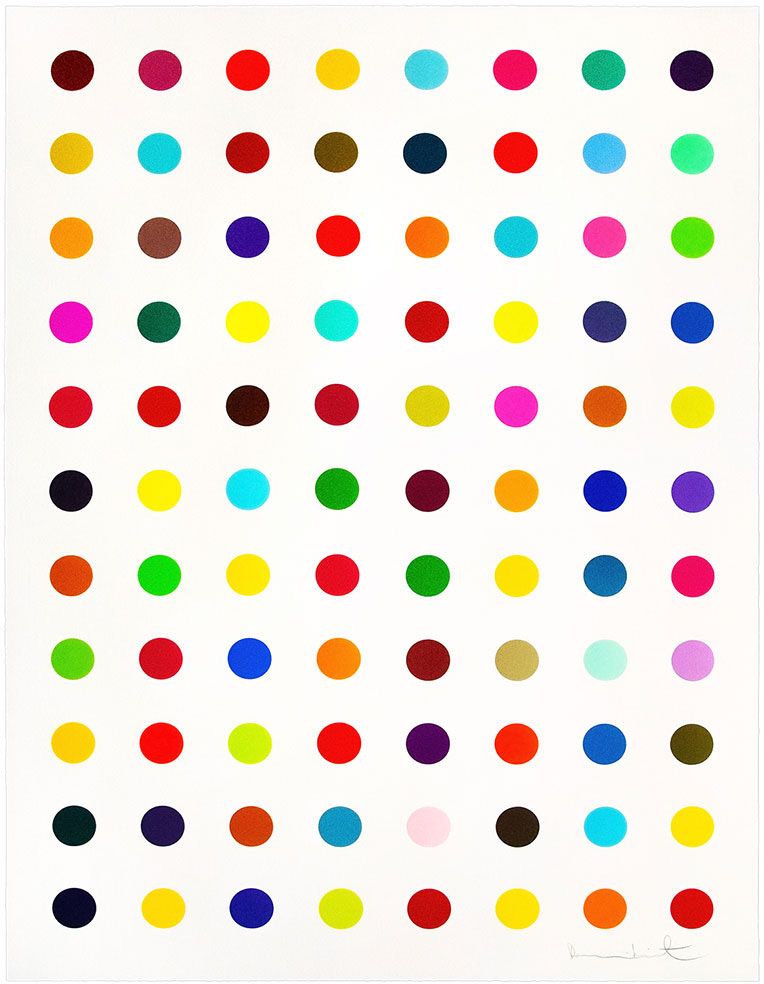

Several weeks ago the art collective MSCHF bought a Damian Hirst print, cut out its 88 spots, and sold the now hole-filled print for multiples of its original cost. This “new” piece is derivative—and yet, it somehow became more valuable with every missing spot. The destruction was just a remix though. It’s still art.

I believe limited partners underestimate their ability to make art through their investing. It’s an easy mindset to fall in—we’re just limited partners, with little-to-no influence with investment firms and their portfolio companies. However, by making the effort to meet investors who think differently and showing the conviction to invest with them, one will build a portfolio of styles that otherwise wouldn’t be replicable in a single opportunity. Thus, art.

This art isn’t so different from the kind painters and singers and writers make. The investor canvas just happens to be a spreadsheet, the portfolios their product. And like all art, the portfolios are never finished—they’re ever-changing as positions fall in and out of favor, and as new opportunities branch out. Or spring anew.

What I’ve read recently:

Clubhouse, Hype & Startups. For those of you who productively spend your free time off of Twitter, you may not know about the new/exclusive social app Clubhouse. Despite not being one of the cool kids on the platform (c’est la vie), what’s interesting to me about their story is how they created hype among potential investors. To quote Fred Destin:

It’s quite the shortcut, creating a hype wave within the circle that’s going to fund you. I can only admire the marketing prowess.

It’s amazing how few investors (both emerging and established) understand this—raising capital from limited partners is much easier if there’s some sense of hype around the process. Otherwise, potential limited partners won’t feel the pressure to invest. This doesn’t mean an investor should use high-pressure sales tactics (please don’t, you’ll just pressure me into a quicker “no”). The pitch and the interactions still need to be authentic to the investor. That said, if a fundraising process doesn’t generate hype, that investor should probably examine their chosen approach.

The Playing Field. I wish I’d discovered Graham Duncan’s post sooner. To single out just one quote:

“The critical challenge for Level 3 investors is to find a way to be exposed to Level 4 investors. If their world consists of only Level 2 and 3, they may stay where they are for the rest of their careers.”

This quote still works if you replace “investors” with any other profession: athlete, musician, TikToker, etc. Being exposed to the best in any field shows you the real benchmark to strive for (and exceed).

I remember the last time I met with an investor who fit Graham’s definition of “Level 4”. By the time of that meeting, I was already familiar with this investor’s firm: the performance, the team, the strategy, the vast majority of the information that plays into an investment decision. It was my first time meeting the founder however.

Most pitch meetings follow a similar path. We easily could have defaulted to that path and re-hashed information in their pitchbook, but instead we took a different route. We talked about the firm’s direction to that point, the way forward over the coming years, and each of our approaches to investing. The game being played wasn’t the rehearsed fundraising pitch—it was the conversation itself.

It brought me back to my experience as a boxer in college, how the punches themselves were only a piece of the action. The real action was the dance: the in-between, the movement in the ring as each fighter decides how and where and when to engage and disengage. Questions and answers calculated in the moment, thrown back and forth—the text of the conversation may have been about investing, but the subtext was the dance.

Leaving that meeting, I realized I was probably following the right path. That combining creativity and conviction could maybe separate me not just from other limited partners, but investors in general. And, that leveling up further would require me to find more of those “Level 4 investors”, to partner with the masters in the field, and to continue learning from them over and over and over again.

This was a much longer post than usual. Apologies. Enjoy the final two episodes of The Last Dance. And here’s a painting that used to have 88 spots.